As mask-wearing begins to take center stage around the country, there’s a lot of questions about how masks might affect the wearer as they go about their daily lives.

Is wearing a mask all day safe? Will I get sick from wearing a mask too much? Will it restrict my breathing? Will I learn that I need to eat more Altoids?

There’s nothing wrong with asking these questions. We’re in a new world, and you only learn by asking questions. But I decided to take it a step further by doing a little experimenting.

Now, I’m a healthy individual, and most of my work involves sitting at a desk looking at a glowing rectangle all day. So, I figured I would wear a mask, and see how it affected me. But to make things more quantifiable, I decided to log my oxygen saturation levels of my blood with a pulse oximeter that I purchased in the beginning of May. You can find the exact one I purchased here.

To try and replicate a typical workday, here was my methodology:

- At 8 a.m., I put my mask on and took a reading

- Around every 15 minutes, I took another reading

- I put the results in a Google Sheet, along with any notes about that moment

- I took the mask off at lunch time

- I took the mask off at two other times when I gave myself a break

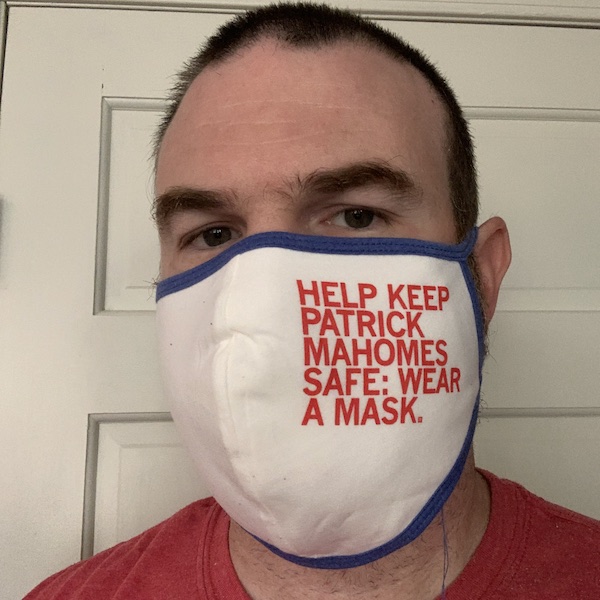

- Every time I took the mask off, I went outside

A little bit about my mask: It’s a standard cloth mask that can be found for sale almost everywhere by people who can sew better than me. It has elastic loops, and a slot where I can put a filter inside of it. My filter is a blue shop rag from Scott I purchased from Home Depot.

So what did I find about my experiment?

- I didn’t experience any negative health complications from wearing a mask all day

- Around noon, the loops around my ears started to get a little uncomfortable

- On video conferences, people appeared to be able to hear me fine

- I felt a little silly wearing a mask while on video

- I didn’t drink enough liquids because taking my mask off would require me to go outside (I really tried to keep this as realistic as possible)

- I drank 1/2 cup of coffee, which is way lower than usual

- I was happy to take it off at the end of the day

But what about the data? Tell us about the data!

I put my data in this Google Sheet. Feel free to check it out for yourself. I’m happy to report that my pulse oxidation levels appeared to stay above the norm for the whole day, according to Mayo Clinic. I don’t think I would want to repeat this daily, as that would certainly require a new mask every day, and it isn’t the most pleasant experience to work with a mask on.

However, it is doable — at least for me — and it certainly beats shutting down a business.

TLDR; I wore a mask all day and didn’t experience anything negative, aside from not getting nearly enough coffee.